Case-Shiller is Crap

There are few things that drive me more crazy than national news agencies telling me what the real estate market is based on what is happening in either New York or LA or because of some foolish index says. I think it is irresponsible, unprofessional, and, more importantly, wrong 90+% of the time.

There are few things that drive me more crazy than national news agencies telling me what the real estate market is based on what is happening in either New York or LA or because of some foolish index says. I think it is irresponsible, unprofessional, and, more importantly, wrong 90+% of the time.

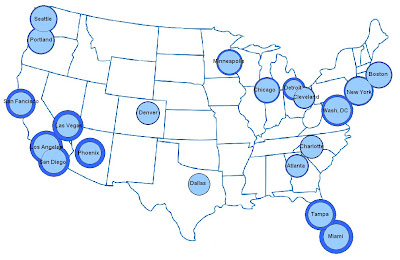

For those of you unfamiliar with the Case-Shiller Index, it comes in a few varieties. The one most commonly referred to in predicting real estate market trends, specifically pricing trends, is a 20 city composite of sales price data. There is also a 10 city composite and a couple of others. Now, while I believe that Kase, Shiller, and Weiss, the guys who came up with it, had the best intentions when it comes to compiling reliable data on pricing and market trends, it has been co-opted since they sold out to Fiserve and S&P. They even trade futures on the Chicago Mercantile Exchange based on the data.

There are two major reasons why I really don’t like this format for looking at national housing data market. The first is that it is inherently flawed in that real estate is hyperlocal, not national. Second, it omits some of the most active markets in the US.

Real Estate is Hyperlocal, not National

So, let me ask you this: If you needed to know the weather in Houston, TX this weekend, would you look at the weather in Boston to predict it? Of course you wouldn’t. It’s really the same problem as national political polling. Who cares what is happening in Ohio if you live in Colorado? It is an even bigger mess when you take the Electoral College into account. Why even do a national poll on presidential politics? Now, you might think, much like the Dow Jones Industrial Average, that taking a composite of the larger real estate markets out there might give you a good idea of the big picture, right?

Well, again, that is a fairly flawed premise. The reason is that inside of each city you experience a more local version of the national problem. For instance, in the Chicago real estate market, there are enormous shifts in sales prices and activity throughout the different areas of the city. Telling me that my house won’t sell in Chicago because an index of the entire city says it won’t is nuts. I need to know what is going on in my neighborhood. I need a local Realtor to pull sales data and show me current trends that affect my property.

Where’s The Beef?

So, you can find the index cities by checking Wikipedia, but let me give you a brief synopsis. It has a bunch of big cities and metro areas in it. However, it leaves a few of the big ones out as well. The crazy bit is, that since the inception of the Case-Shiller Index in the early 90′s, it has left out one of the hottest and largest housing markets in the country, Houston, Texas. It also leaves out Austin and San Antonio, Texas. Why is that important?

The Case-Shiller Index has grown in popularity with the growth of around-the-clock news organizations, particularly those that are business oriented, i.e. FoxBusiness, MSNBC, CNBC, etc. It has also become an ever-increasingly popular measuring stick since the downturn that hit the US housing market in 2007-ish. During that time, Houston, Austin and San Antonio have set the pace for the US real estate market, along with the Dallas-Fort Worth Metro, which is included in the Index. So how can you tell me that the US housing market is terrible when you are missing the 4th largest city in the country and 2 of the other top 10 markets in the country during that time period?

Believe me when I tell you that I don’t need to be told that the housing market in Detroit is terrible. In fact, I would argue that Detroit should probably be dropped from the index. I would call Detroit an extreme outlier. In stark contract, especially in the past 5-6 years since the housing downturn began, the Great State of Texas has been the driver of the national economy. As such, the Texas markets should be included if you want to paint an accurate picture of the national market. I mean, if you’re going to include Tampa Bay and Cleveland, don’t you at least think that Houston ought to be in there?

So, as you can see, I put very little stock into this measurement and I think you should completely ignore the national news media if they tell you the sky is falling. In every market, in every city, there are good times and bad. Real estate is a historically cyclical corner of the economy. My advice to you, for what it is worth, is find a local Realtor who know the market and get a local opinion, based on hyperlocal data, and not from a talking head in NY, LA, or Atlanta.